QuickBooks Certification made easy

Includes QuickBooks Online (QBO), QuickBooks Desktop, and Bookkeeping Professional exams

- Earn your QuickBooks certification and boost your career

- Know exactly what your QuickBooks certification costs — and what's included

- See simple steps that show you how to get QuickBooks certified

- Official Intuit QuickBooks Certification: takes just 20 hours, online, lasts forever

See how it works

(1:18)Not ready for certification yet? Try our QuickBooks Classes for live instruction,

or explore QuickBooks Courses to learn at your own pace

QuickBooks certification help

You get all 3 QuickBooks certification exams

($390 value), and we'll help you ace the exams with QuickBooks classes, hands-on exercises, and sample tests.

Trusted by Intuit for 25 years

Intuit QuickBooks sends their employees to our training to learn QuickBooks. We can help you, too.

Money back guarantee

You'll love our QuickBooks training and Live Help for QuickBooks. If you're not satisfied, just contact us within 30 days for a refund.

Become a QuickBooks Certified User today

You don't even need to own QuickBooks! All you need is an internet browser

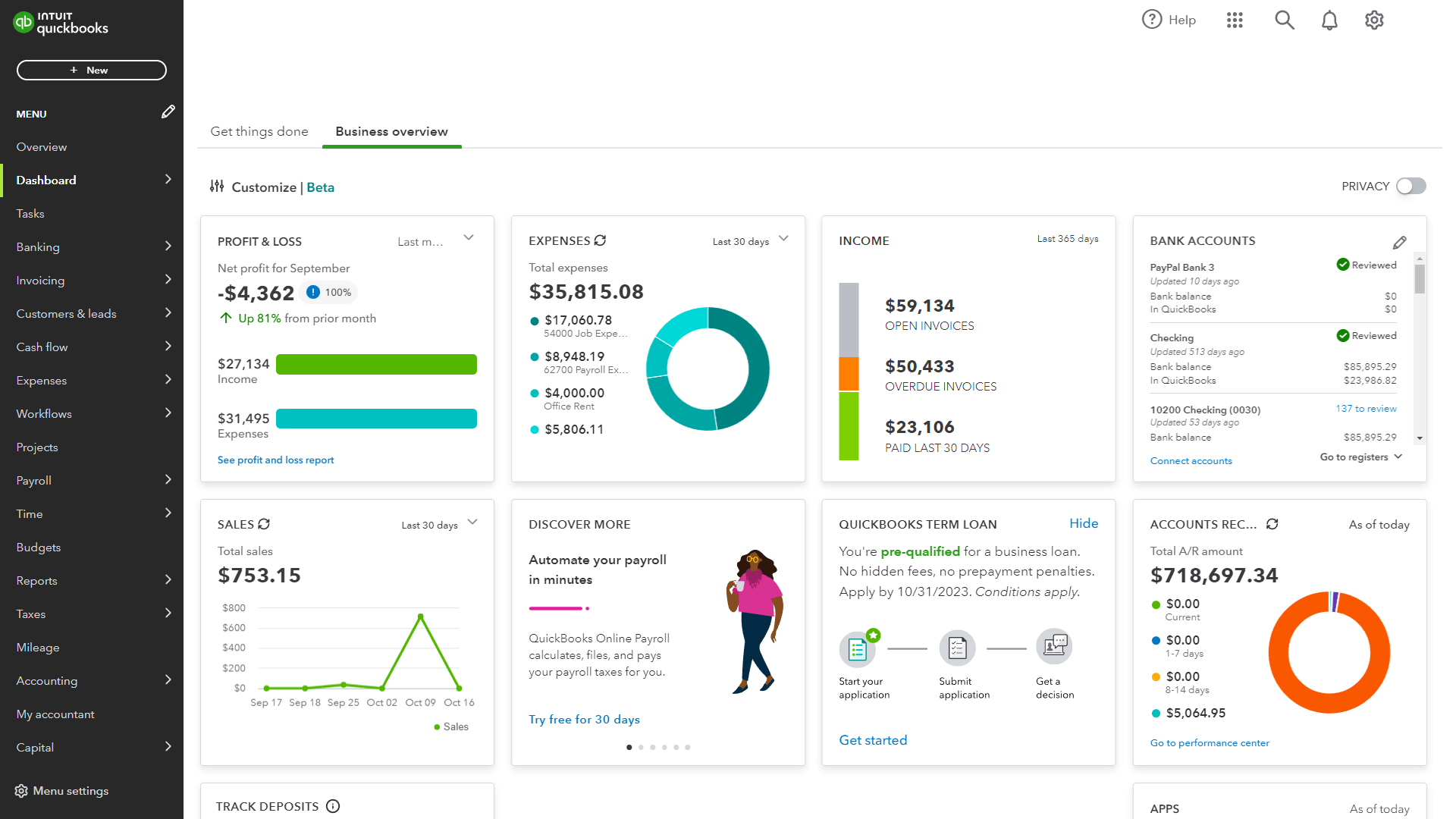

Boost your resume by becoming QuickBooks Certified in QuickBooks Online (QBO)

Validate your QBO knowledge with multiple-choice, matching and True/False questions

Earn your official Intuit QuickBooks Certification by passing a 60-question online exam

Boost your resume by demonstrating your official QuickBooks Certificate in Bookkeeping

Validate your bookkeeping skills with multiple-choice, matching, and True/False questions

Achieve your Intuit QuickBooks Certification by passing a 60-question online exam

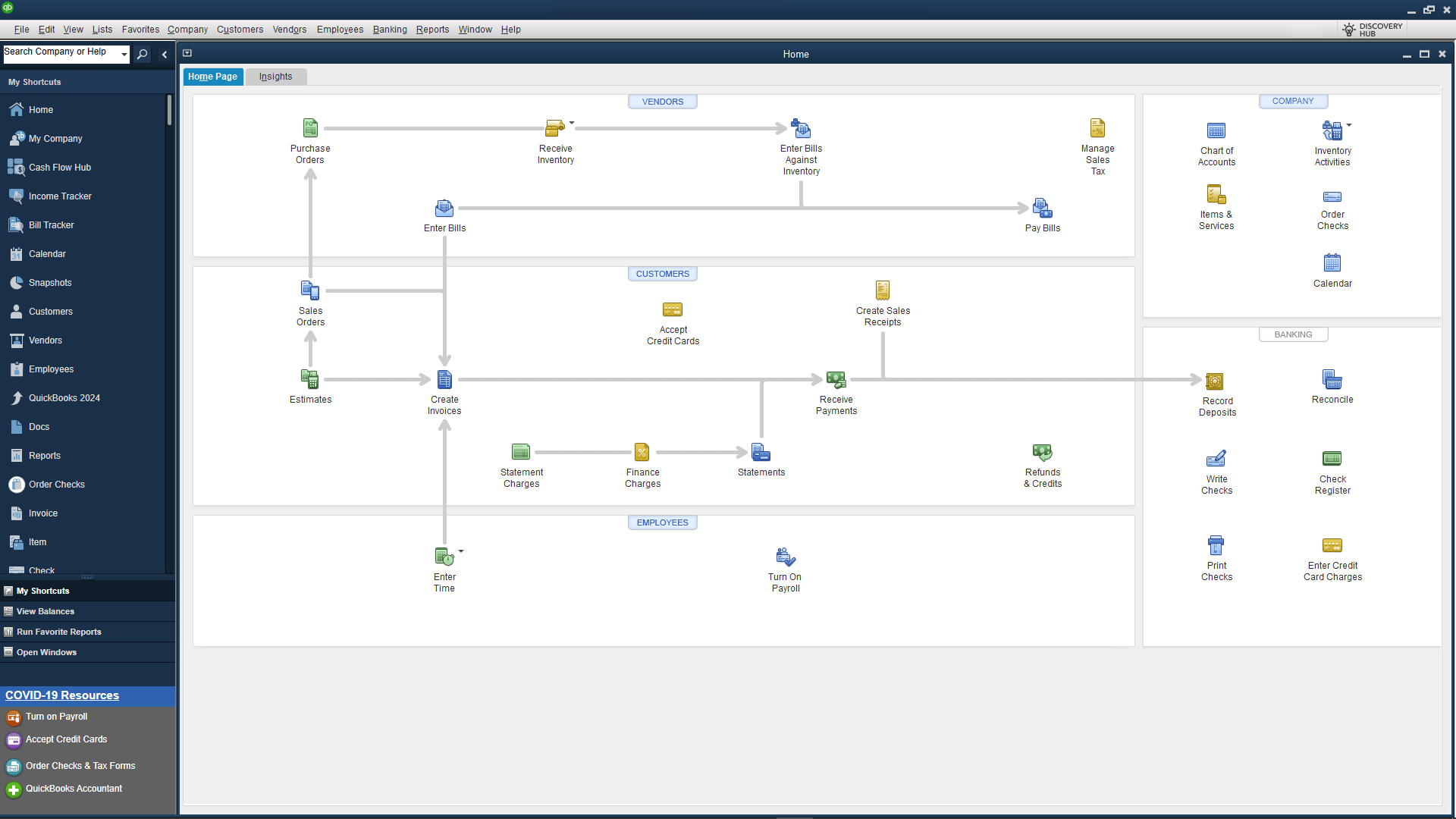

Boost your resume by getting QuickBooks Certified in QuickBooks Desktop

Validate your Desktop knowledge through targeted multiple-choice questions

Earn your official Intuit QuickBooks Certification by passing a 47-question online exam

Choose your QuickBooks Certification cost and plan

Includes 30 days FREE Live 1-on-1 Help!

Then, $50/month for Live 1-on-1 Help. Cancel anytime.

All other benefits and classes are yours for LIFE!

Live 2-day QuickBooks classes

100+ Self-paced and live classes

Live 1-on-1 Help w/your books. No call center, no appointment—just click to talk to an expert

Includes 30 days FREE Live 1-on-1 Help!

Then, $50/month for Live 1-on-1 Help. Cancel anytime.

All other benefits and classes are yours for LIFE!

Live 2-day QuickBooks certification classes

100+ Self-paced and live classes

Live 1-on-1 Help w/your books. No call center, no appointment—just click to talk to an expert

Training for all 3 QuickBooks certifications —

includes 3 free exams ($390 value)

Includes 30 days FREE Live 1-on-1 Help!

Then, $90/month for Live 1-on-1 Help. Cancel anytime.

All other benefits and classes are yours for LIFE!

Live 2-day QuickBooks certification classes

100+ Self-paced and live classes

Live 1-on-1 Help w/your books. No call center, no appointment—just click to talk to an expert

Training for all 3 QuickBooks certifications —

includes 3 free exams per user ($1950 value)

20 hours to QuickBooks certification success

Learn

13 hours

Gain everything you need to confidently pass your QuickBooks Certification exams. Live and self-paced classes fit any schedule.

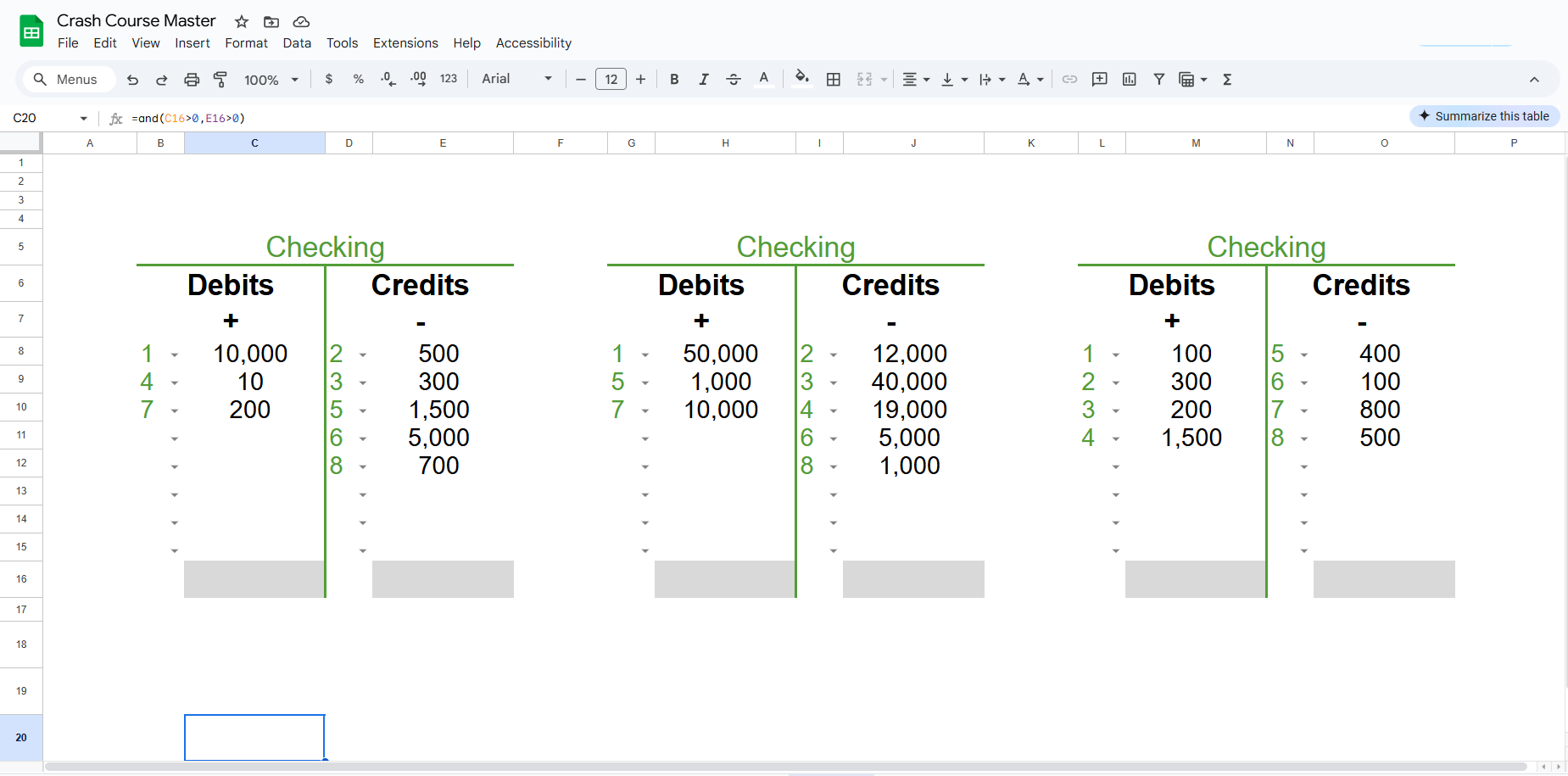

Practice

6 hours

Get hands-on experience with interactive exercises and realistic QuickBooks Certification practice tests.

Pass

1 hour

Complete your QuickBooks Certification exams online in just one hour per exam. Free retakes included.

QuickBooks Training options

Learner1 user |

Certification1 user |

Team2-5 users |

|

|---|---|---|---|

|

QuickBooks FAST-Track (Live): Learn QuickBooks basics in two days with an expert instructor. |

Yes

|

Yes

|

Yes

|

|

QuickBooks Basics (Self-paced): Easy-to-follow, |

Yes

|

Yes

|

Yes

|

|

Daily Live Deep-Dives: 50+ engaging 1-hour classes. View the QuickBooks Classes schedule. |

Yes

|

Yes

|

Yes

|

|

Learn Anytime: 100+ on-demand QuickBooks classes. Browse all QuickBooks Courses. |

Yes

|

Yes

|

Yes

|

|

Lifetime Access: Unlimited retakes for ALL classes |

Yes

|

Yes

|

Yes

|

|

Always Fresh: All classes automatically update whenever QuickBooks changes. |

Yes

|

Yes

|

Yes

|

|

Live 1-on-1 Help: Personalized 1-on-1 instructor help via Zoom (first 30 days FREE). |

Yes

|

Yes

|

Yes

|

|

Bonus: 3 FREE QuickBooks certification exams with retakes—a $390 value. |

|

Yes

|

Yes

|

|

Certification Made Easy: Friendly classes to help you ace your exams! |

|

Yes

|

Yes

|

|

Exam Confidence: Interactive quizzes and practice tests make passing exams easy. |

|

Yes

|

Yes

|

|

Grow Your Career: Become an Intuit Certified Bookkeeping Professional with our Crash Course in Bookkeeping. |

|

Yes

|

Yes

|

|

Train your team: Up to five users can access the full training library and all live classes. |

|

Yes

|

Yes

|

|

Coming Soon: Easy monitoring & tracking of your team’s learning. |

|

|

Yes

|

|

Learner Plan

original price:

$59995

+ $50/month to continue Live 1-on-1 Help is free for 30 days. |

Certification Plan

original price:

$69995

+ $50/month to continue Live 1-on-1 help is free for 30 days. |

Team Plan

original price:

$99995

+ $90/month to continue Live 1-on-1 help is free for 30 days. |

How we compare to other training

|

Our QuickBooks training

|

DIY (YouTube, Reddit, etc)

|

Other training providers

|

|

|---|---|---|---|

|

Includes all official Intuit QuickBooks Certification exams (normally $390 total) |

3 exams for each user

|

Never

|

Rarely

|

|

Certification exams co-created directly with Intuit QuickBooks |

Yes

|

|

|

|

Live & self-paced QuickBooks classes beyond certification |

Yes

|

|

|

|

Hands-on exercises for real-world QuickBooks experience |

Yes

|

|

|

|

Online interactive practice tests to build your confidence |

Yes

|

|

|

|

Live 1-on-1 instructor support via Zoom |

Yes

|

|

|

Frequently asked questions

QuickBooks certification is an official credential provided by Intuit QuickBooks that validates your knowledge, skills, and expertise using QuickBooks for accounting and bookkeeping. We offer three certifications:

• QBO Certification (QuickBooks Online) – proves your ability to manage business accounting using QuickBooks Online.

• QuickBooks Desktop Certification – validates your proficiency with QuickBooks Desktop software.

• Certified Bookkeeping Professional Certification – demonstrates broader bookkeeping and accounting skills beyond QuickBooks.

Getting QuickBooks certified is easy! It's also included free. Simply enroll in our clear, user-friendly training program, learn from live and self-paced classes to master the material, and build your confidence with interactive practice exams. When you're ready, pass your online QuickBooks Certification exam and immediately enhance your resume and career potential!

Our plans include comprehensive QuickBooks Certification training with live and self-paced options, plus 3 free exams ($390 value) and ongoing one-on-one support. All of this is available for individuals for $699.95 and $999.95 for teams of 2 to 5 people.

Yes!

”QuickBook Certification” is simply a common way people search for “QuickBooks Certification.” They’re exactly the same official credential offered by Intuit QuickBooks—no matter how you type it, earning it boosts your skills, credibility, and career opportunities.

Becoming QuickBooks Certified is straightforward and rewarding! Just join our easy-to-follow training program, choose live or self-paced classes that fit your schedule, and build your skills through interactive practice. Once you're ready, pass the certification exam online and instantly elevate your professional credibility and career prospects!

Great news—your QuickBooks Certification never expires! Once you're certified, you're certified for life. You’ll permanently enhance your resume, career opportunities, and professional credibility without needing to retake the exam.

Intuit QuickBooks Certifications include QuickBooks Online, QuickBooks Desktop, and Bookkeeping Professional.

Start your path to certification now