Learn QuickBooks

No experience needed

QuickBooks training that's live, clear, and easy

- Learn the basics fast in a live 2-day class

- Get clear, step-by-step help from real QuickBooks experts

- Walk away with real-world QuickBooks skills

- Expand your QuickBooks skills with 50+ focused 1-hour classes

See how it works

(1:30)Want extra confidence with QuickBooks? Explore QuickBooks Certification

Prefer self-paced learning? Browse QuickBooks Courses

Trusted by Intuit for 25 years

Even Intuit sends their teams to us for QuickBooks training. If they trust us, you can too.

QuickBooks training is all we do

Over 1,000,000 people have learned QuickBooks with us—and now use it with confidence

Money back guarantee

Try our training risk-free. If it’s not the right fit, you have 30 days to get your money back—no hassle

Explore upcoming live QuickBooks classes

Start with the 2-day QuickBooks class, then attend any 1-hour classes you need----all included.

| Date & Time | Class Title | Instructor |

|---|---|---|

|

Jan 26

- 27

|

QuickBooks Foundations for Online and Intuit Enterprise Suite | |

|

Jan 28

- 29

|

QuickBooks Foundations for Online and Intuit Enterprise Suite | |

|

Feb 02

- 03

|

QuickBooks Foundations for Online and Intuit Enterprise Suite | |

|

Feb 04

- 05

|

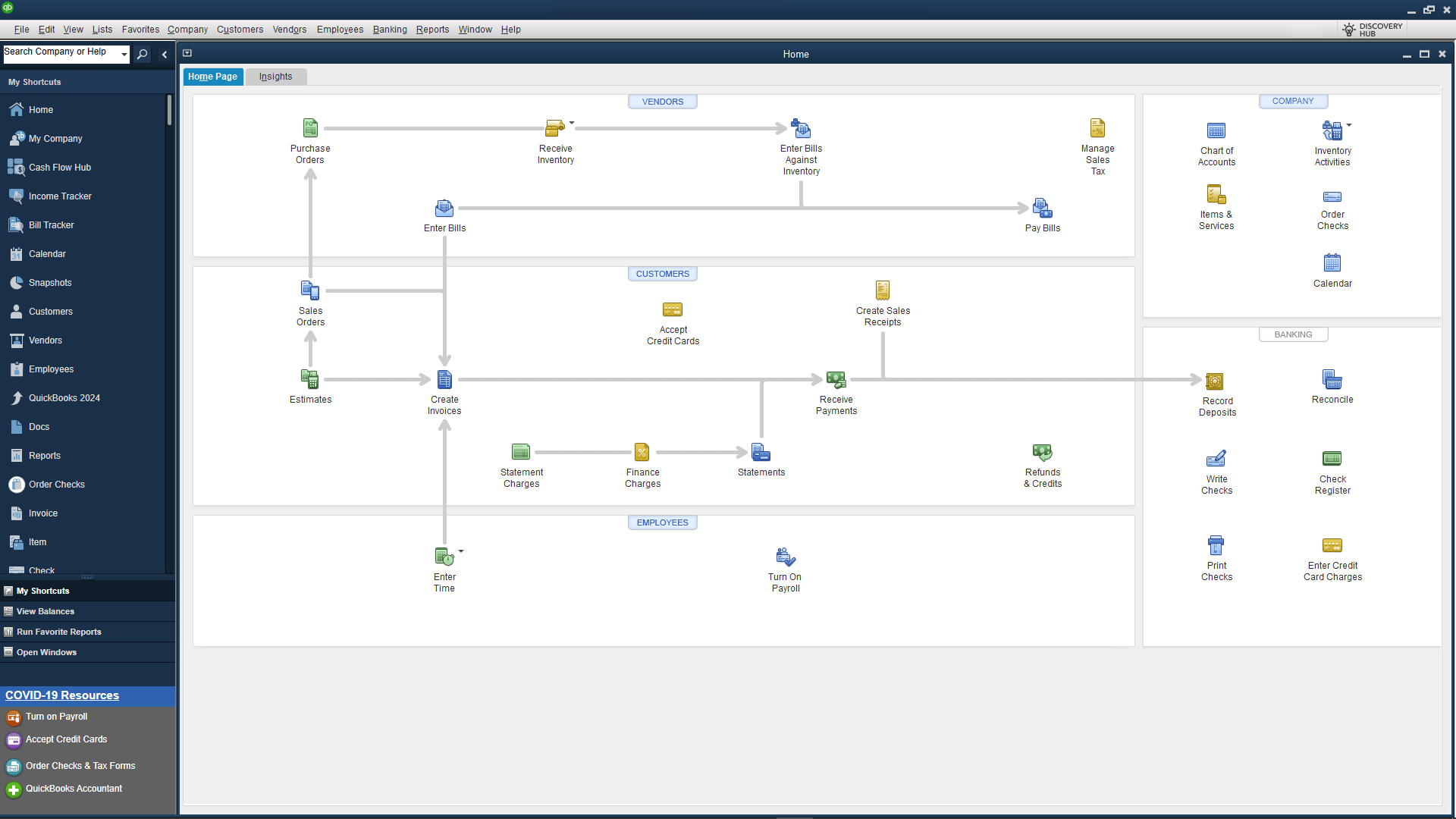

QuickBooks Foundations for Desktop | |

|

Feb 04

- 05

|

QuickBooks Foundations for Online and Intuit Enterprise Suite | |

|

Feb 09

- 10

|

QuickBooks Foundations for Online and Intuit Enterprise Suite | |

|

Feb 11

- 12

|

QuickBooks Foundations for Online and Intuit Enterprise Suite | |

|

Feb 17

- 18

|

QuickBooks Foundations for Online and Intuit Enterprise Suite | |

|

Feb 19

- 20

|

QuickBooks Foundations for Online and Intuit Enterprise Suite | |

|

Feb 23

- 24

|

QuickBooks Foundations for Online and Intuit Enterprise Suite | |

|

Feb 25

- 26

|

QuickBooks Foundations for Desktop | |

|

Feb 25

- 26

|

QuickBooks Foundations for Online and Intuit Enterprise Suite |

Live 2-day QuickBooks class

View full class outline| Date & Time | Class Title | Instructor |

|---|---|---|

|

Mon 01/26

10:00AM-11:30AM

|

Projects & Job Costing for Online | |

|

Mon 01/26

11:45AM-1:15PM

|

Get Started for Online | |

|

Mon 01/26

1:30PM-3:00PM

|

Bookkeeping Fundamentals: Money-In/Money-Out | |

|

Tue 01/27

10:00AM-11:30AM

|

Track Who, What and Why with Lists for Online | |

|

Tue 01/27

11:45AM-1:15PM

|

Understanding Financial Statements for Online | |

|

Tue 01/27

1:30PM-3:00PM

|

W-2's and 1099's for Online | |

|

Wed 01/28

10:00AM-11:30AM

|

Track and Record Sales for Online | |

|

Wed 01/28

11:45AM-1:15PM

|

Track and Record Expenses for Online | |

|

Wed 01/28

1:30PM-3:00PM

|

Best Tricks to Save Time for Online | |

|

Thu 01/29

10:00AM-11:30AM

|

Use Online Banking for Online | |

|

Thu 01/29

11:45AM-1:15PM

|

Bookkeeping Fundamentals: Complex Entries/Bookkeeping Extras | |

|

Thu 01/29

1:30PM-3:00PM

|

Reconcile Your Accounts for Online | |

|

Fri 01/30

9:30AM-5:30PM

|

Bookkeeping Professional |

After class, ace your QuickBooks Certification to show the world what you learned

Choose your path to QuickBooks confidence

Includes 30 days FREE Live 1-on-1 Help!

Then, $50/month for Live 1-on-1 Help. Cancel anytime.

All other benefits and classes are yours for LIFE!

Live 2-day QuickBooks classes

100+ Self-paced and live classes

Live 1-on-1 Help w/your books. No call center, no appointment—just click to talk to an expert

Includes 30 days FREE Live 1-on-1 Help!

Then, $50/month for Live 1-on-1 Help. Cancel anytime.

All other benefits and classes are yours for LIFE!

Live 2-day QuickBooks certification classes

100+ Self-paced and live classes

Live 1-on-1 Help w/your books. No call center, no appointment—just click to talk to an expert

Training for all 3 QuickBooks certifications —

includes 3 free exams ($390 value)

Includes 30 days FREE Live 1-on-1 Help!

Then, $90/month for Live 1-on-1 Help. Cancel anytime.

All other benefits and classes are yours for LIFE!

Live 2-day QuickBooks certification classes

100+ Self-paced and live classes

Live 1-on-1 Help w/your books. No call center, no appointment—just click to talk to an expert

Training for all 3 QuickBooks certifications —

includes 3 free exams per user ($1950 value)

You’re in good company

Meet a few of your QuickBooks Instructors

They're a special group of people-friendly, knowledgeable, and patient.

They truly care about you and your success!

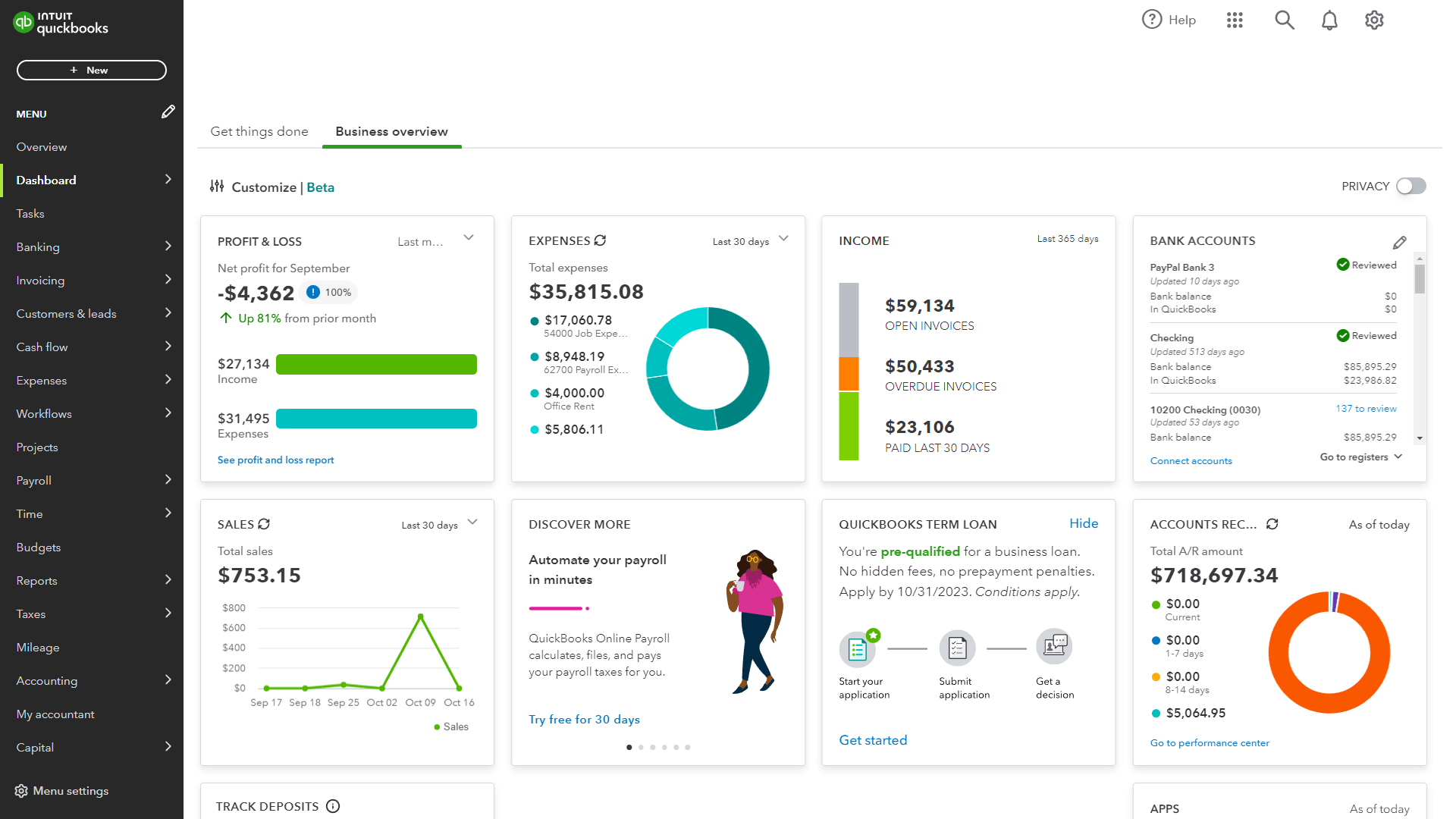

Discover what you'll learn during your live QuickBooks class

Click on each section to see more detail

- Set up your company in QuickBooks

- Get around in QuickBooks

- Set up accounts and beginning balances

- Enter historical transactions

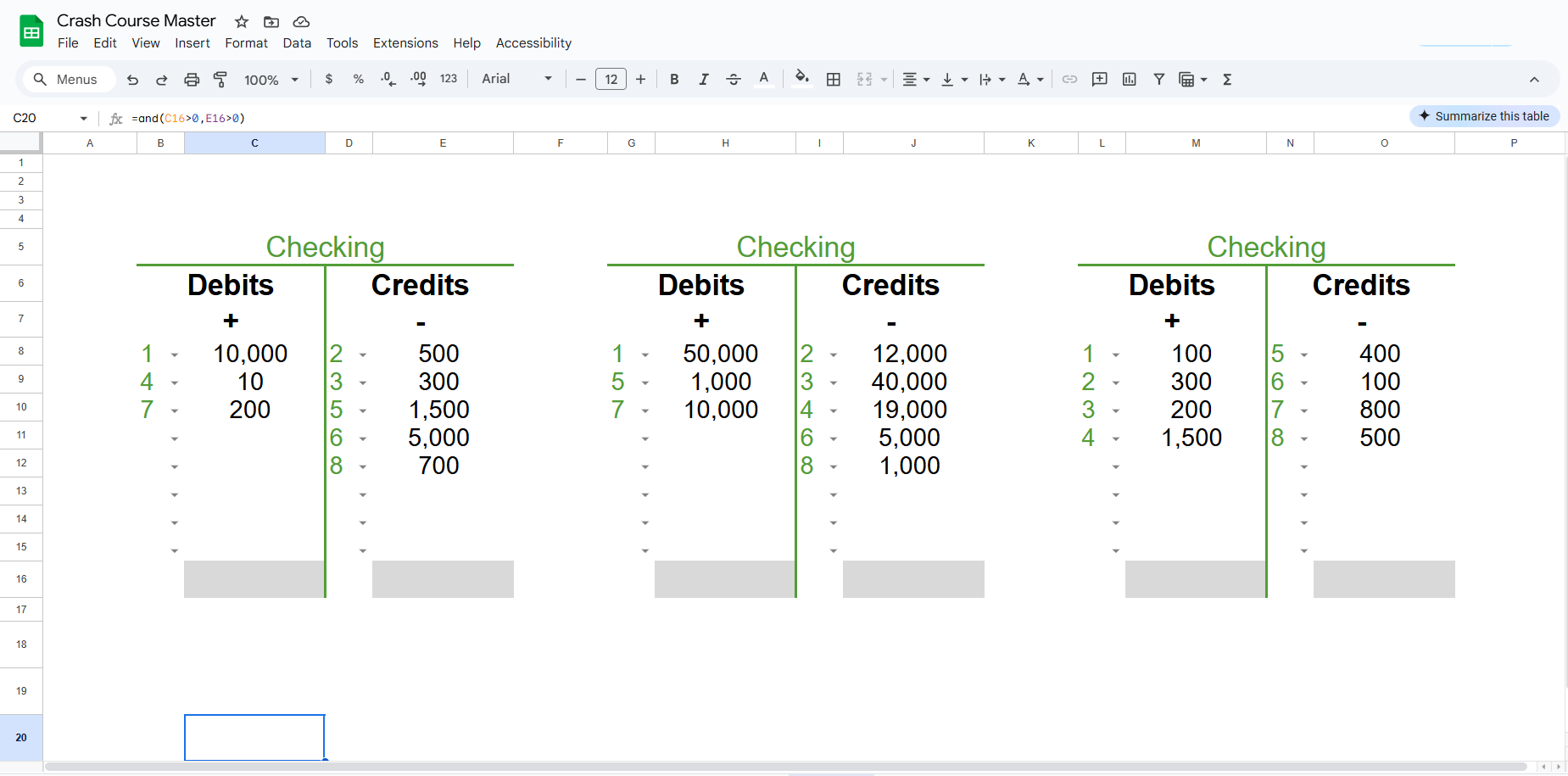

- Understand the elements of a transaction

- Set up your customers, vendors, and accounts

- Add, edit, merge, and delete list entries

- Read your Balance Sheet and Profit & Loss statement

- Understand which accounts appear on each statement

- Organize your Chart of Accounts with subaccounts

- Learn the basics of journal entries

- Set up the products and services you sell

- Enter invoices and sales receipts

- Combine multiple payments into a batch deposit

- Generate and send statements to customers

- Run sales reports to discover your best products and customers

- Customize your sales form style, color, and logo

- Record refunds and credits to customers

- Enter bills, checks, and expenses

- Print checks

- Set up credit cards and record charges

- Enter and use credits from vendors

- Understand when and how to void or delete a transaction

- Download transactions directly from your bank and credit cards

- Add and Match downloaded transactions

- Discover when you should exclude a transaction

- Enter personal expenses

- Record transfers between bank accounts

- Enter credit card payments

- Learn how to confirm your data with a reconciliation

- Use reconciliations to identify problems with your books

- Learn how to use account registers

- Understand which reports to run and when

- Customize columns: add, reorder, delete, and resize

- Save report customizations so you can rerun them later

- Understand cash versus accrual reporting

- Set up users and permissions

- Use reports to find changes to transactions

- Close the books

- Learn how to work with your Accountant

- Find what you're looking for with multiple search options

- Set up recurring transactions

- Set up employees, deductions, and company contributions

- Track time worked

- Process paychecks

- Check Review tax payments and forms

- Set up and track inventory

- Record inventory purchases and sales

- Correct inventory levels when something goes wrong

- Set up sales tax tracking from scratch

- Understand sales tax options for products/services and customers

- Record taxable and non-taxable sales

- Run sales tax reports

- Review and pay sales tax

Join 1,000,000+ people (just like you) that became QuickBooks Confident!